It doesn’t feel like that long ago that investors were on the ‘hunt for yield’. A seemingly perpetual challenge and, after a decade of falling market interest rates, investors were bereft of income opportunities. Everyone just accepted that ‘lower for longer’ was the ‘new normal’ – until it all changed.

The Reserve Bank, in broad alignment with global central banks, began a rate hiking cycle not seen for a generation. We had a yield curve again. Income offerings lifted. For investors, everything started to feel a little bit ‘normal’. Certainly, more normal than the rationalised ‘new normal’ most had come to accept.

Of course, volatility in markets is perpetual. Remember, the uplift in interest rates was partially a response to turbocharged inflation numbers caused by the invasion of Ukraine. Even now, ongoing escalations threaten stability. We never know what’s around the corner.

For investors, it remains a matter of building portfolios which address longer term needs, while remaining cognisant that we never know when the next extraordinary event will occur.

It is in these volatile moments – indeed during all economic and market cycles – that La Trobe Financial shines as a generator of low volatility income.

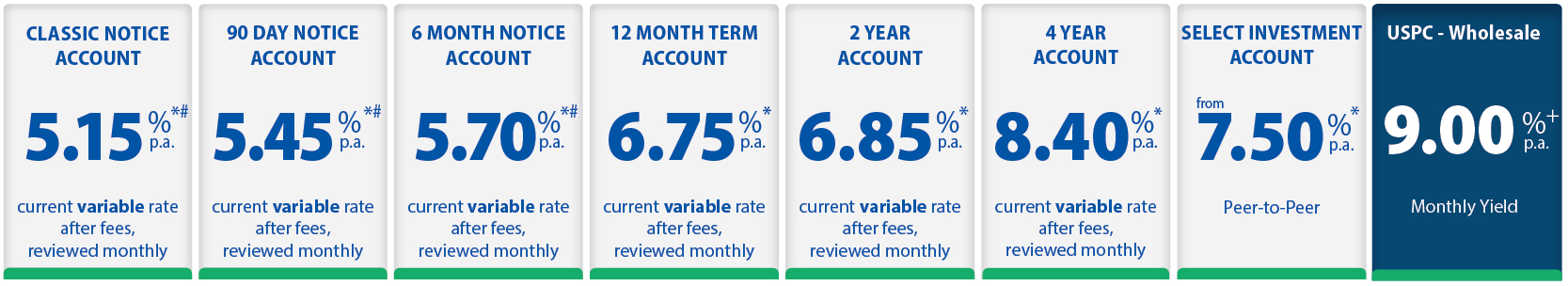

This month, I am pleased to confirm a further uplift in the interest rates across a number of our portfolio investment accounts. These increases are delivered on the back of sustained income uplifts and ongoing portfolio health.

We are delighted to offer the following investment returns from 1 April 2024:

The delivery of another increase to returns is not by accident. Our ongoing commitment to our investment fundamentals, supporting our proven delivery of a premium, low-volatility income across all points of the market and economic cycle.

It is the quality and the performance of the assets which sit within investment portfolios which drive these outcomes. And as a business, we are continuing to observe a very healthy pipeline of high quality loan assets. In fact, in the month of February we settled a new peak: 1.1 billion dollars of new loan settlements. An outstanding achievement, and we can’t just understate the importance of having such strong origination volumes, allowing our portfolio managers to select from the highest quality loan assets to the benefit of you, our investors.

And our investment portfolios remain in tremendous shape, with borrower arrears – a potential canary in the coal mine for portfolio health – remaining low and controlled. In fact, Credit Fund arrears concluded February at just 3.6%, sitting well within our longer-term historical average range of 2.5-4%. A reflection of the high-quality borrowers we target and the strength of our deep-dive credit assessments.

As we have been saying for some time now, the hunt for yield is over, and the hunt for quality has begun. At La Trobe Financial, we have been delivering quality products for decades, with our portfolio products providing the low volatility yield so prized by the market.

And with nearly 100,000^ investors from Australia and around the world, that’s looking out for you®.

*The rates of return will be effective from 1 April 2024. The rates of return are reviewed and determined monthly are not guaranteed, and may be lower than expected. The rates of return are determined by the future revenue of the Credit Fund, and distributions for any given month are paid within 14 days after month end.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund when deciding whether to invest, or continue investing, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

# We will make every endeavour to release your funds after receiving your withdrawal request: within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account, and 180 days for the 6 Month Notice Account. However, we have 12-months under the Fund’s Constitution to fulfill the request. When determining whether to honour your withdrawal request within the specified timeframes we have to have regard to the Fund’s ability to realise for value the relevant assets and the best interests of investors. While there is a risk of not honouring your withdrawal request within 2 business days, 90 days or 180 days, it’s important to note that there has never been a case in the history of the Fund when we have not honoured a withdrawal request on time due to a lack of liquidity.

^Total investors is calculated by adding all individual & joint investors (which includes some investors with a current zero balance in their account) to reasonable estimates of investors investing via platform, trusts or SMSFs.

+ The offer to apply for Class A Units in the La Trobe US Private Credit Trust is open to wholesale investors only. Investors applying to invest less than $500,000 will need to produce an accountant’s certificate to support their wholesale status. For more information, please refer to the Application Form (Annexure 2 to the Information Memorandum).

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2024 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.