Last week, the Reserve Bank of Australia (RBA) released its updated Statement on Monetary Policy (SoMP).

The SoMP sets out the RBA’s view on the local and global economies and how these are likely to shape its thinking in the years ahead. But more than this, investors can use the SoMP to decipher how these economic tea-leaves may impact individual investment portfolios.

Macroeconomic landscape

Globally, the RBA notes how the pace of economic recovery has been uneven. While advanced economies have witnessed an upward revision in growth projections for 2023, they’re still grappling with the after effects of the pandemic.

Economic giants like the United States and the European Union – although recovering – have had to navigate inflationary pressures, supply chain disruptions, and labour market adjustments. Sound familiar?

The situation in Asia is diverse. While China’s economic rebound post-COVID restrictions has been commendable, recent slowdowns and volatility – especially in its property sector – pose a different challenge. In India, the economic trajectory continues upwards on the back of a robust recovery, with strengthening domestic demand and rising exports likely to drive a positive economic story for the years ahead.

Altogether, the global picture is positive. The key narrative of superpower economies largely avoiding recession, together with the continuing development of economies such as India, all bode well for our local economy: net positives for exports, trade, investment, and financial markets.

So where to from here?

The forecast for economic growth in Australia – per the SoMP – remains positive. Australia will likely avoid a recession with the RBA potentially achieving the ‘soft-landing’ it has been attempting to walk the ‘narrow path’ towards.

But it’s not ‘mission accomplished’, and we are not there yet. There may yet be a further pulling of the rate-rise lever, and the extent to which rates remain elevated remains unclear.

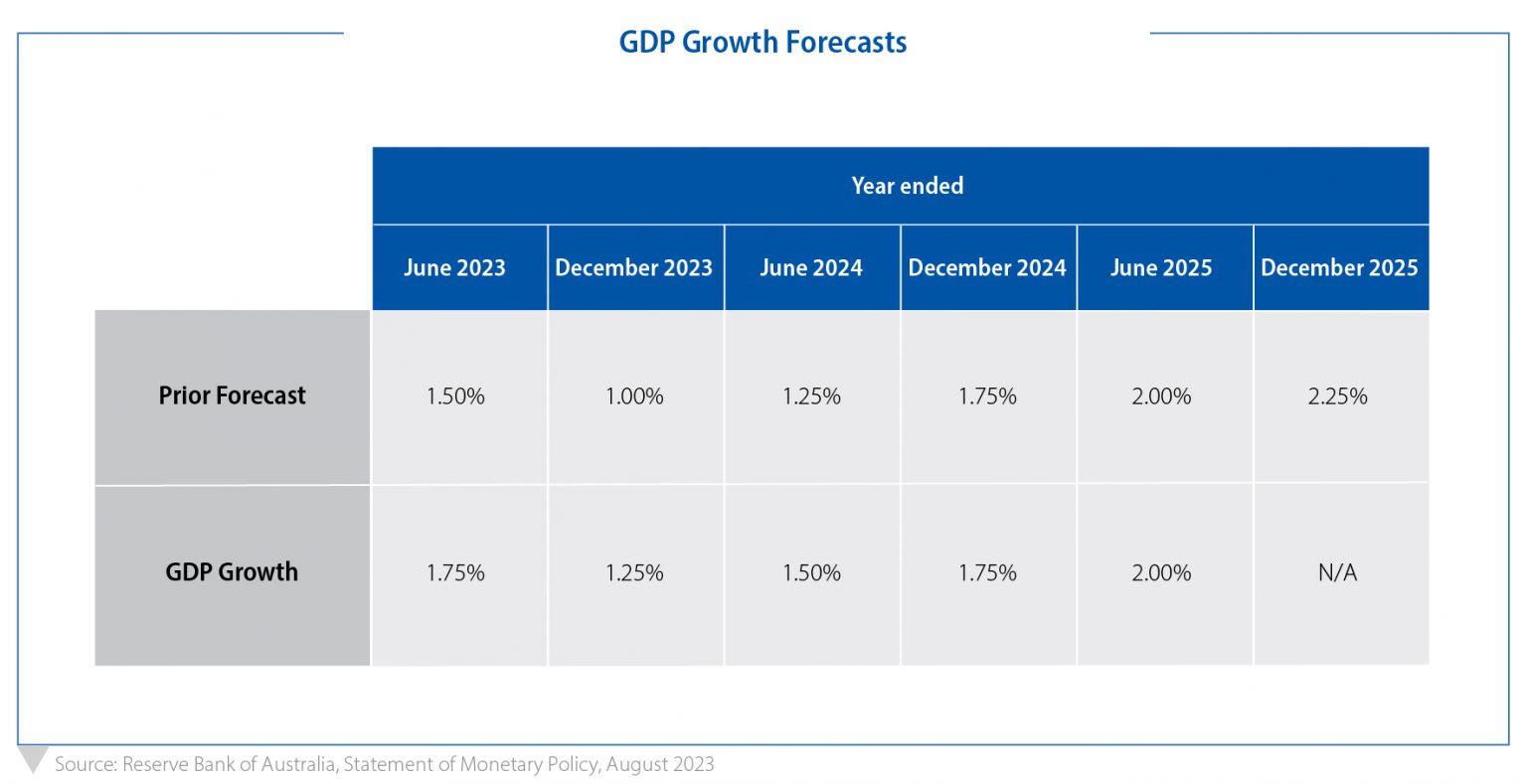

All of this means that local economic growth forecasts remain lacklustre. As noted in the following table, GDP growth in the next 12 months has been revised downwards and remain soft out to the end of 2025.

Make no mistake, on the back of a global recession, war, and inflationary event, this is a fantastic outcome. The resilience of our economy to ongoing economic shocks continues to surprise on the upside.

So what does this mean for investors?

The RBA, per the SoMP, is forecasting inflation to return to target range in mid-2025. For investors, that means they will be navigating high inflation and market volatility for some time yet. In this period, investors need their portfolio returns to exceed inflation just to preserve the real value of their money.

Traditional sectors like equities will be asked how it can deliver capital growth in a low-growth environment. Certain fixed income investments will see a real challenge in meeting their low-volatility objective while generating positive real returns.

A challenging environment for investors

Last week, we unpacked how investors could consider investing for inflation. We highlighted how allocations to variable rate products make sense in an environment with ongoing inflation and rising interest rates. Variable rate products can assist portfolios to retain their real value by ensuring your income isn’t going backwards in real terms.

Including exposures to income investments focussed on providing a steady stream of income – and not typically correlated to share or bond markets – can help manage portfolios through volatile times. These regular income-generating investment streams can provide predictability and stability to overall portfolio returns, while incomes can be reinvested or used to meet living expenses.

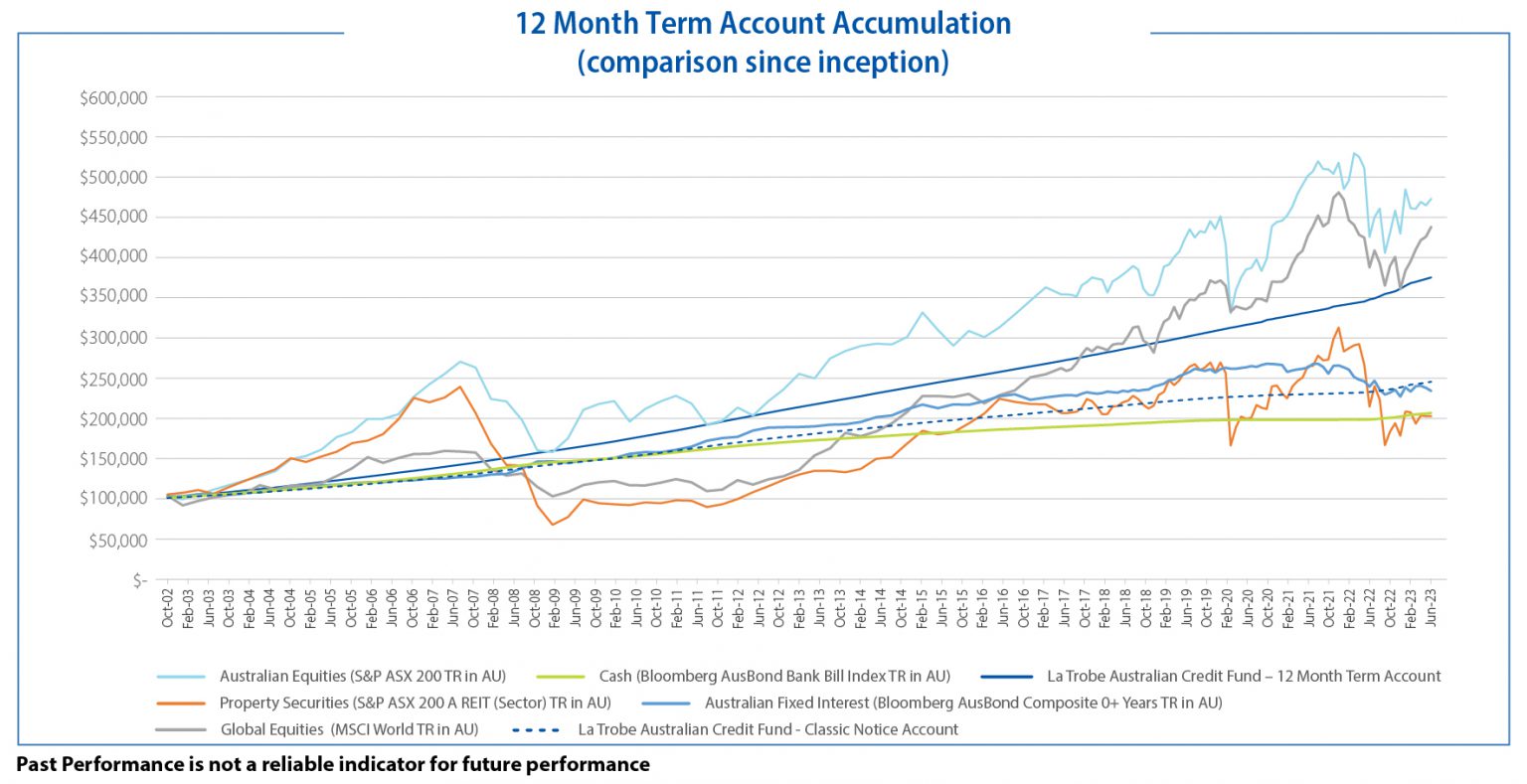

Credit funds are one of these types of regular income-generating investments. While they have their own investment risks, they generally offer a highly repeatable and sustainable way to add value to an investor’s portfolio. You can see in the asset class comparison chart below the consistency of returns since inception that our 12 Month Term Account has provided:

La Trobe Financial, and the long history of success of our Credit Fund products make a strategic allocation to property credit an easy choice for investors.

Our range of products provide investments with various return and duration profiles to suit investor’s needs, and demonstrated performance at all points along the economic cycle.

*The rates of return on your investment are current at 1 August 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

Past Performance is not a reliable indicator of future performance.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.