Did investor demand for private assets see more companies go private? Or did more quality companies opting to raise capital through private market attract investors? It’s a little bit of ‘chicken and egg’.

But it doesn’t really matter.

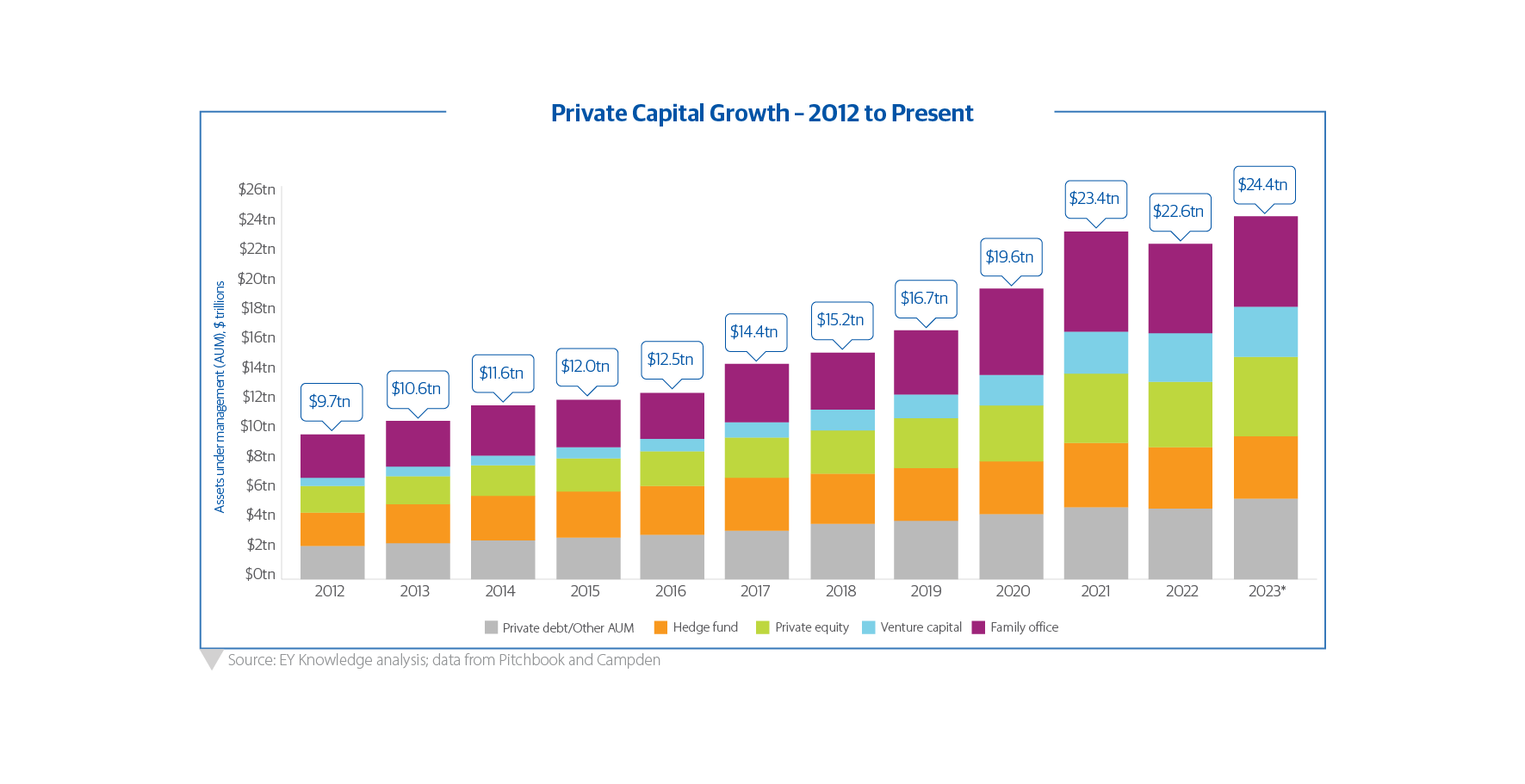

Private capital markets are increasing significantly in size globally, and there is opportunity all over. Because having reached a critical mass, there is significant opportunity coming for retail investors to now participate right across private markets. These are not new types of assets or new types of investments. It’s just that until now, they have largely been the domain of the institutional and wholesale investors.

It is providing a formidable wall of opportunity for investors to consider.

The Opportunity for Investors

While institutional and wholesale investors have long been able to participate in private capital markets, retail investors are now having opportunities made available from this enormous wall of quality assets. This, in isolation, could itself determine investment trends for a generation. But there’s more.

A super cycle of investment is forecast across four key areas:

Digitalisation will see over $1 trillion in investment over the next ten years to enhance data storage, processing and transmission infrastructure.

Decarbonisation will necessitate $150 trillion in investment over the next 30 years to support decarbonization of global energy systems.

Deglobalisation, as countries and companies onshore critical industries, anticipate $1 trillion of investment over the next ten years; and,

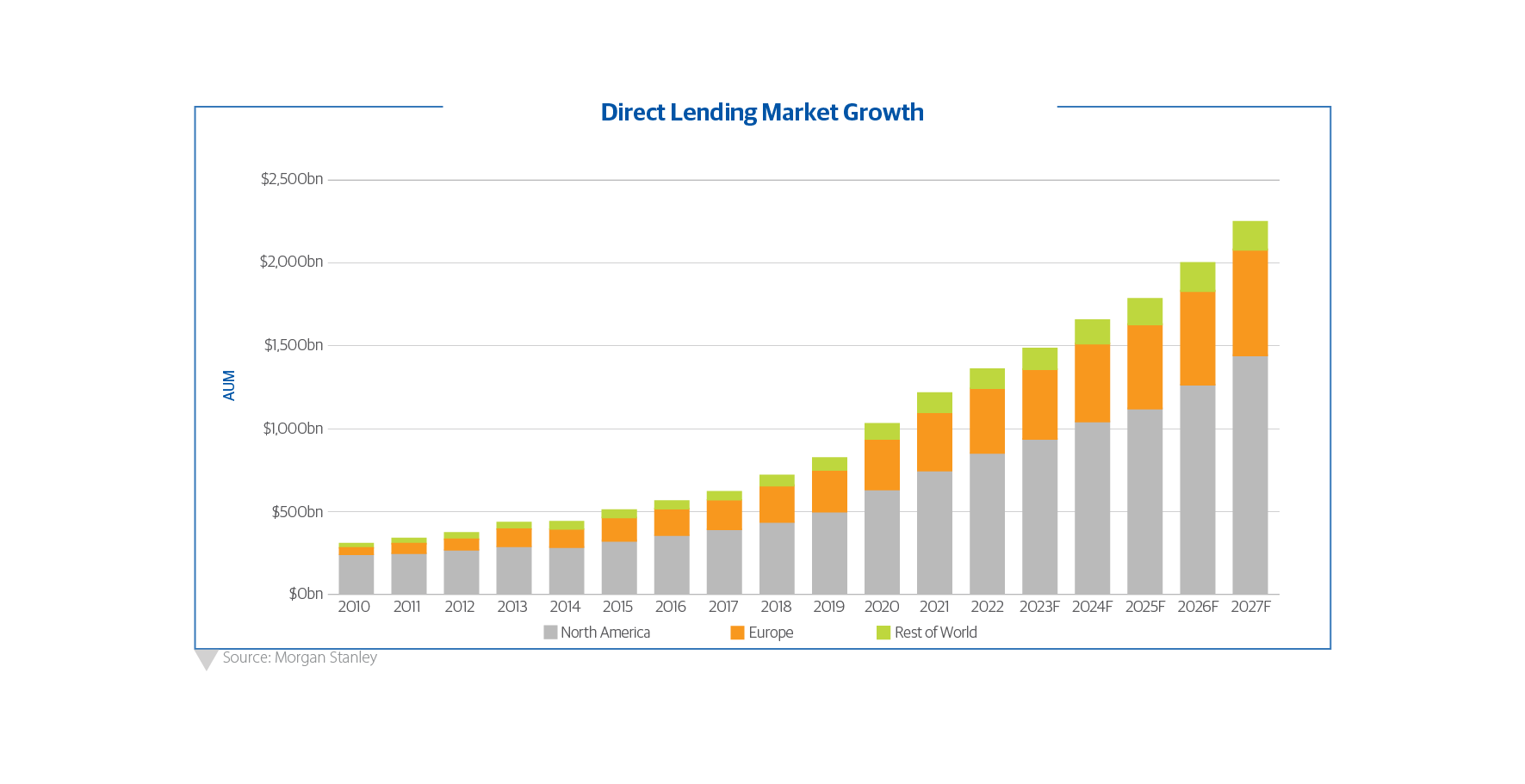

De-banking, as ever-increasing compliance and capitalisation requirements see bank market shares shrink, private lending groups are stepping in to provide capital. Globally, private credit markets now comprise a $3 trillion asset class globally.

The fundamentals of these growth areas and the assets they will generate align with the needs of investors. They are long-term trends. They are quality assets. They are sectors less prone to wild swings in value. And they will generate income.

Why Private Credit Makes Sense

Focusing on De-Banking as a subset of the private capital market, it’s becoming impossible to ignore the very old, but ever-growing field of Private Credit.

Private Credit can mean a lot of different things. It can refer to Real Estate Private Credit, the foundational asset class of the La Trobe Australian Credit Fund. Our history in this sector since 1952 now sees us managing nearly $20 billion for institutional, wholesale, and retail investors.

Private Credit can also mean loans to “middle market” corporations written by a non-bank lender. In the USA, the output of these companies alone would make them the third largest economy in the world. Today, there are $1.3 trillion of private credit assets written to US middle market companies – by far the largest market globally.

Since 2005, direct lending to US middle market companies has provided an average total return for investors of about 9.4%pa. It is an asset class where managers can extract value and return for investors, if done right. What’s more, major US asset forecasters predict the sector will provide higher forecasted returns for lower forecasted risk over the coming decade. A compelling case for any investor.

Until now, it has been difficult for any retail investor in Australia to access this asset class.

La Trobe Financial – Expanding Product Range

You spoke, we listened. For years, our investors have been asking for a broader range of investments. So we launched La Trobe Global Asset Management, to bring the world to Australian investors. Our new products will give investors the opportunity to access asset classes and strategies which have previously been exclusive to institutional and wholesale investors.

La Trobe US Private Credit Fund

We are excited to confirm the launch of our inaugural LGAM product to retail investors, the La Trobe US Private Credit Fund. We are incredibly excited about this product, and are delighted to be giving retail investors the opportunity to access this asset class for the very first time.

We designed this product very deliberately: to give Australian investors the opportunity to participate in the generational investment thematic of de-banking, and the growth & power of the US middle market.

The product is unique. With a target yield of 8.5%pa net of fees^, it is a pure-play investment into directly originated, senior secured loans provided to US middle market companies. And these are companies owned by some of the largest private equity firms in the world.

We Look Forward to Telling You More About It

This is a real milestone moment for us as a business, and we look forward to celebrating its release. We will soon be releasing the Product Disclosure Statement (PDS) for you to consider, with the Target Market Determination document is already on our website.

If you have any queries, please contact our LGAM Team on 1800 818 818.

^The target distribution return is net of fees but excludes any adjustments for FX rate fluctuations. This is a target distribution return only, may not be achieved, and is reflective of a return benchmark of the Secured Overnight Financing Rate (SOFR) + 3% and market conditions as at time of publication. The target return is reviewed monthly.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

Past Performance is not a reliable indicator of future performance.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2024 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.