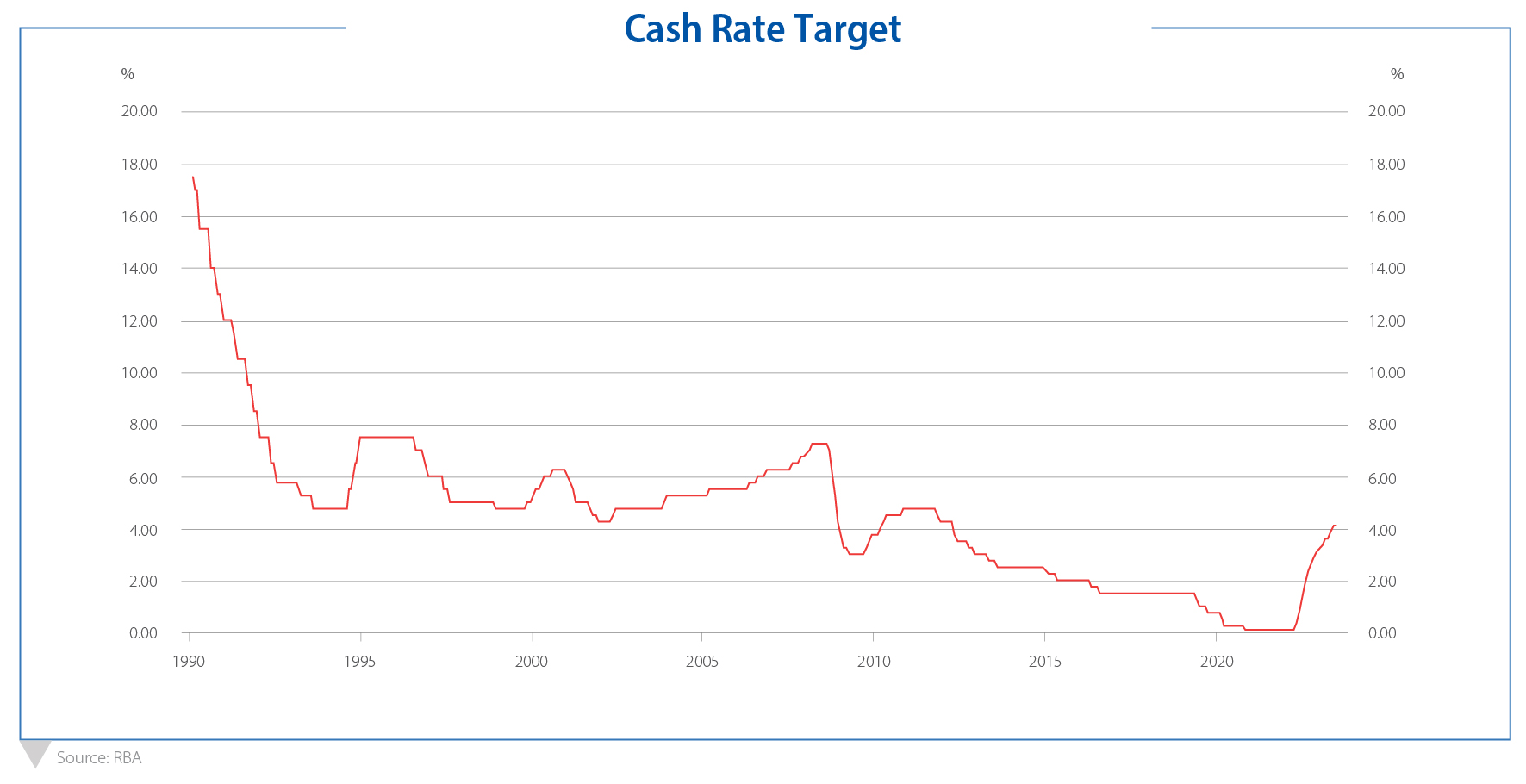

The fastest rate hiking cycle in our nation’s history has had wildly different outcomes for different groups. While younger Australians and some borrowers are undoubtedly feeling the pinch, for investors it has meant that the hunt for yield is over and the focus can turn to addressing volatility and other risks within their portfolio.

In its July meeting, the Reserve Bank of Australia (RBA) surprised some by its decision to hold the cash rate at 4.1%. Surprising in that, in the eyes of most, the June 2023 increase was a sign of more immediate increases to come, and surprising given the nature of the RBA’s language – it’s resoluteness to return inflation to target.

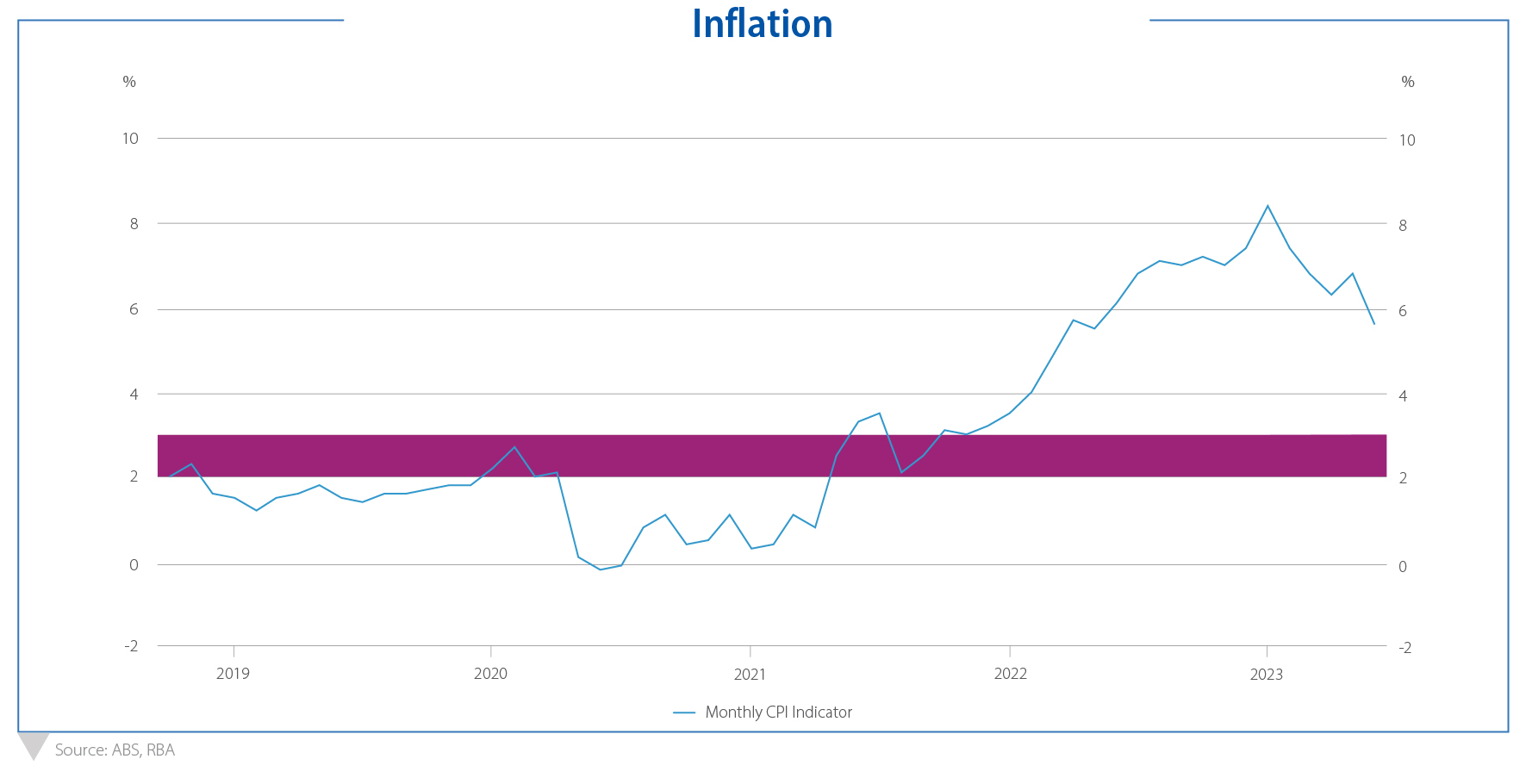

With inflation showing signs of softening, is this the end of the rate hikes, and what might this mean for investors?

To understand the cause for the most recent pause, let’s journey back to where we started. The RBA began hiking rates from May 2022 to counter rising inflation, which soared to a cyclical peak of 8.4% by December 2022. Now in July 2023, the market seems to be at a crossroads. On one hand, economic indicators show slowing economic growth and inflation softening. On the other, the labour market exhibits exceptional vigour, with unemployment rates remaining ultra-low, at levels not seen in some 50 years.

The cumulative results of twelve rate rises since May 2022 are yet to be fully seen and the RBA acknowledges this. The pause is not a reflection of mission accomplished, and certainly not the harbinger of smooth sailing ahead. In fact, the July 2023 RBA minutes are the first since August 2022 which do not mention keeping the economy on its proverbial ‘even keel’.

A rapid cooling of the economy introduces risks of further market volatility. Inflation, likewise, erodes the value of money.

So while the RBA pause might appear as a temporary reprieve for some, vigilant investors will be using this moment to reassess their portfolios. Does the performance of individual products within your portfolio correlate with broader economic performance? If so, what might negative economic growth do to their valuations? Likewise, very few in the market are currently talking about inflation and its impact on the real value of investments.

In moments of uncertainty and volatility, the case for certainty becomes even clearer by investing into products that look beyond the noise of markets and provide inflation-responsive income. At La Trobe Financial, our award-winning Credit Fund has a range of products to suit the return and duration profile of many investors. Our highly diversified portfolios are designed to provide low-volatility income regularly across the economic cycle.

Over 93,000 investors have entrusted us with their wealth, and as careful stewards of investor funds we now manage in excess of $9.5 billion. While the macroeconomic environment can be complex, the solution is often simple and we welcome any queries you may have.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To view our Awards please visit the Awards and Ratings page on our website.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.