Some managers in our asset class boast about the size and return profile of individual loan assets as part of their collective whole. Indeed, smaller managers tend to focus their investments into a small number of large loans, and the performance of their portfolios is driven by the performance of the few. To that end, it makes sense to champion the performance of individual assets.

But portfolio diversification matters, and can make a real difference in investment outcomes.

At La Trobe Financial, our approach is to carefully construct portfolios comprising very granular holdings. That is, a larger number of smaller loans. Such exposures provide a repeatable income experience for our portfolio investors. In fact, the entire Credit Fund now holds exposures across some 11,800 individual loans, with an average amount of just $767,546. We’re not aware of another manager in the sector that comes close to that level of granularity over such a large number of underlying assets.

Our approach to constructing portfolios goes to the heart of who we are as a business – we’re here to serve you, our investor. And in our view, this is the best way of extracting ongoing value for investors with the lowest volatility.

Let’s dig a little deeper.

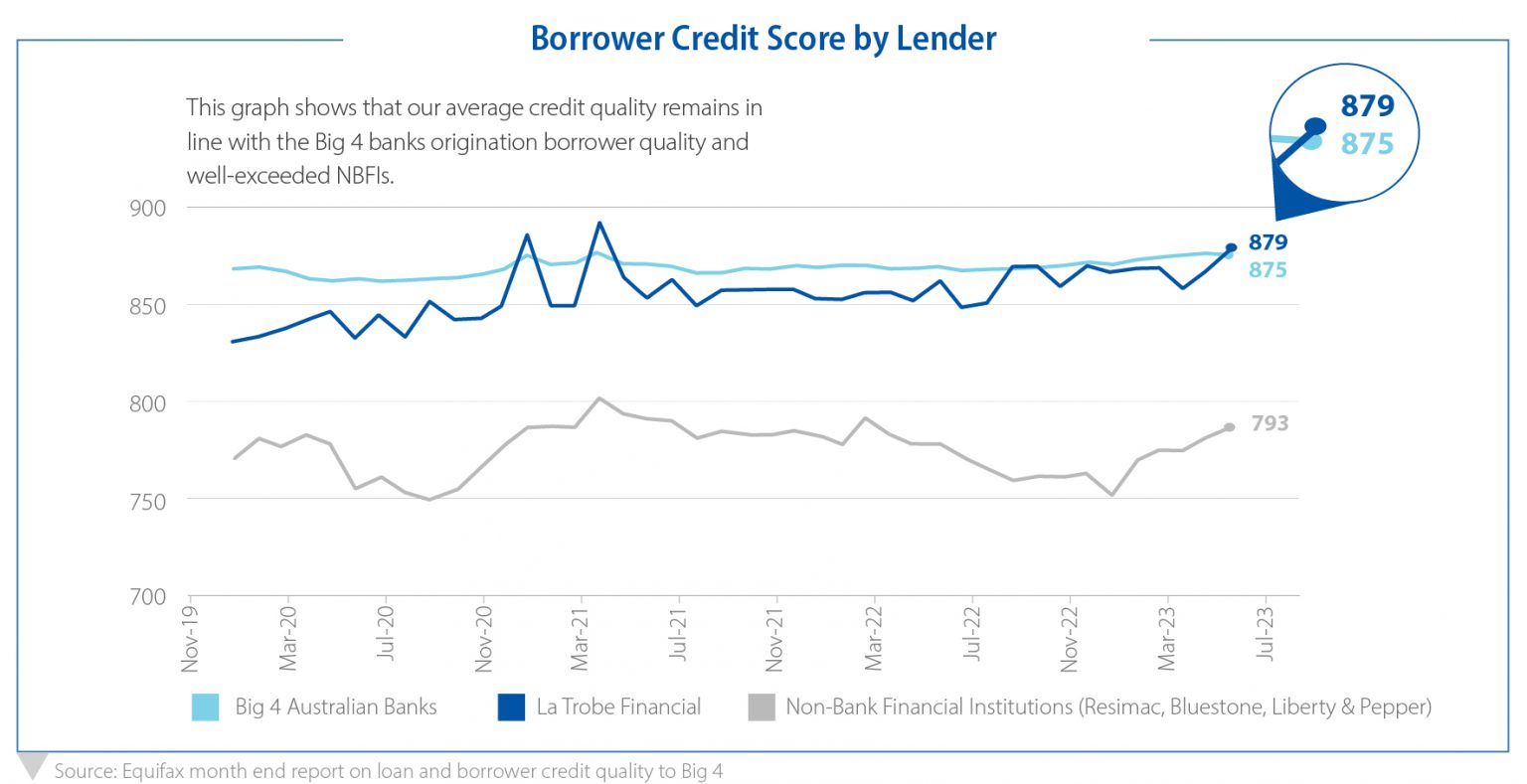

Ask any manager, and they’ll say their portfolios are comprised of high quality assets. But who can actually demonstrate this in a material way? We can. With a staff of over 250, our Real Estate Credit team is the largest in Australia’s non-bank sector. We perform hands-on, deep-dive analyses on each loan application. But more than that, we also monitor our borrower credit scores and make that information public.

The result is that our average borrower has a credit score equivalent to a borrower in a Big 4 Bank. So, when we say our borrowers are of a high quality, we mean it.

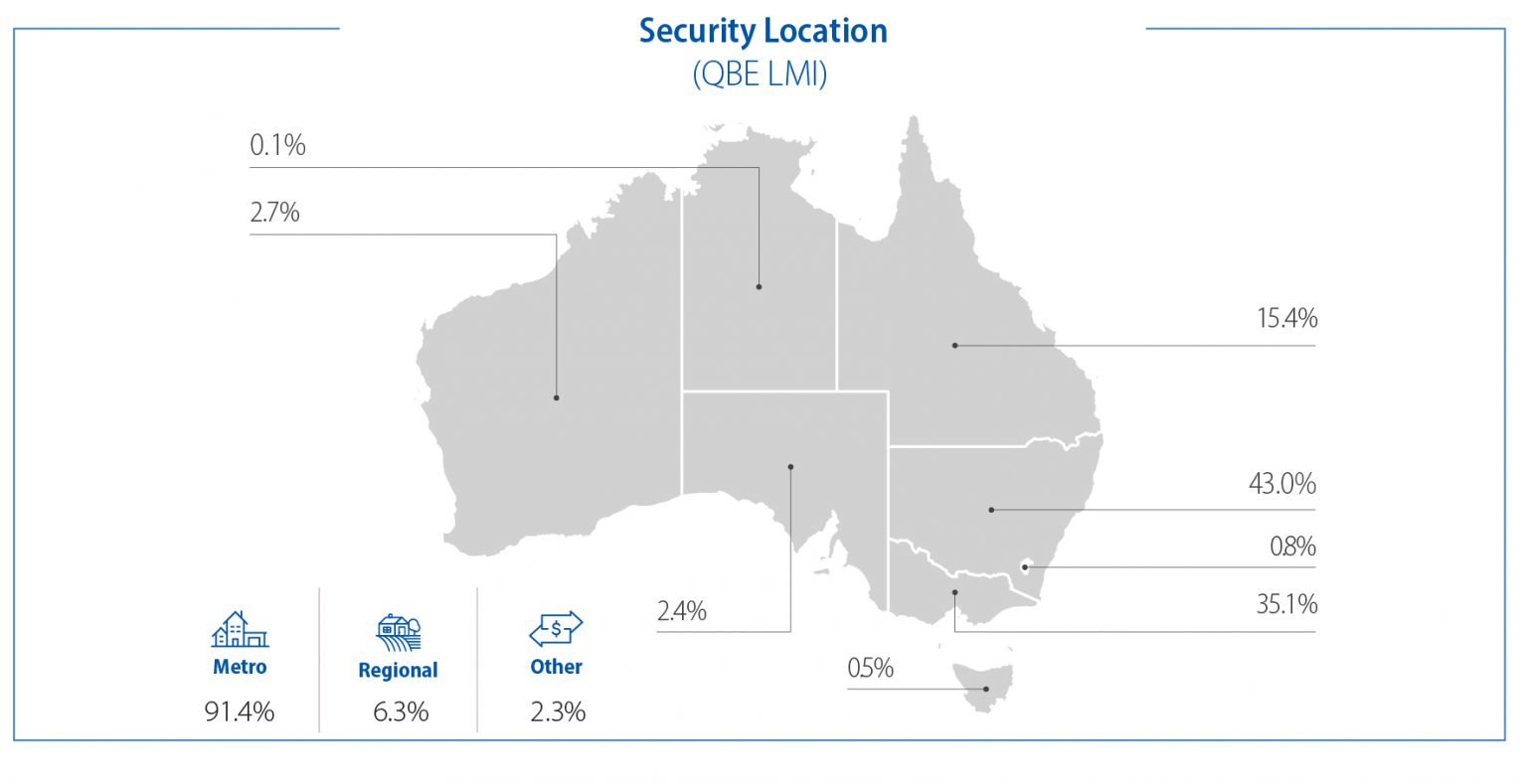

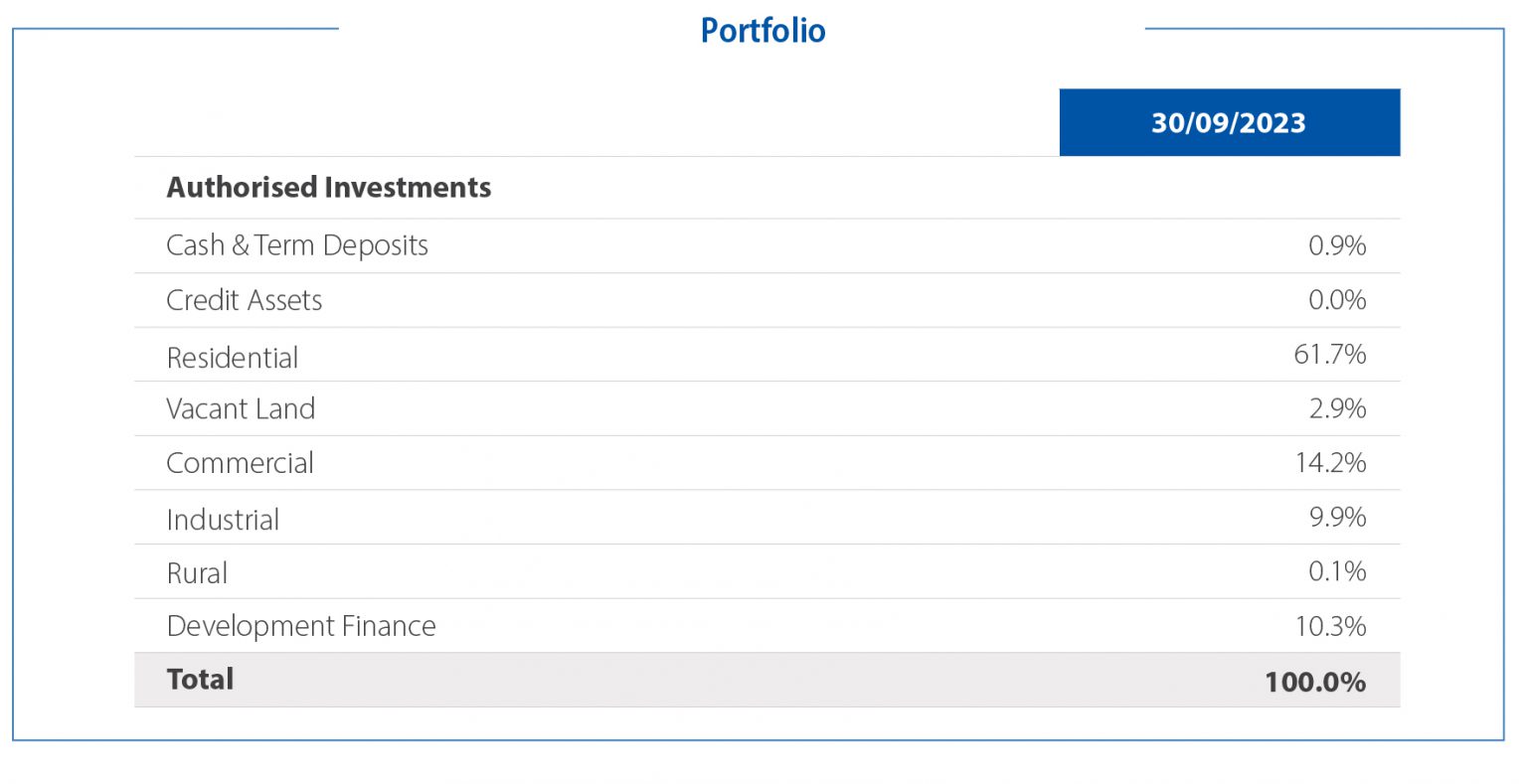

So, after beginning with a high quality borrower, let’s consider security. Conservative maximum Loan-to-Valuation ratios, and the discipline to deliver a low average position across our portfolio accounts puts us in the best place possible to deliver low volatility returns to investors. Consider the 12 Month Term Account. No exposures above 75% LVR, and an average of just 63.4%. But again, there’s more to consider. Our loans follow the population, so are diversified geographically. They’re diversified by sector, with a weighting towards residential, then targeted exposures into other sectors. And they’re diversified by age, with a wide range of loan vintages working for you.

Let’s again dig a little deeper. Our portfolios have been constructed to avoid losses impacting the investor experience. And it has worked. At all times since inception of the fund, across each of our portfolio accounts we have delivered a track record of:

- No investor losses, ever.

- All monthly income paid at the advertised distribution rate; and

- No gating of liquidity.

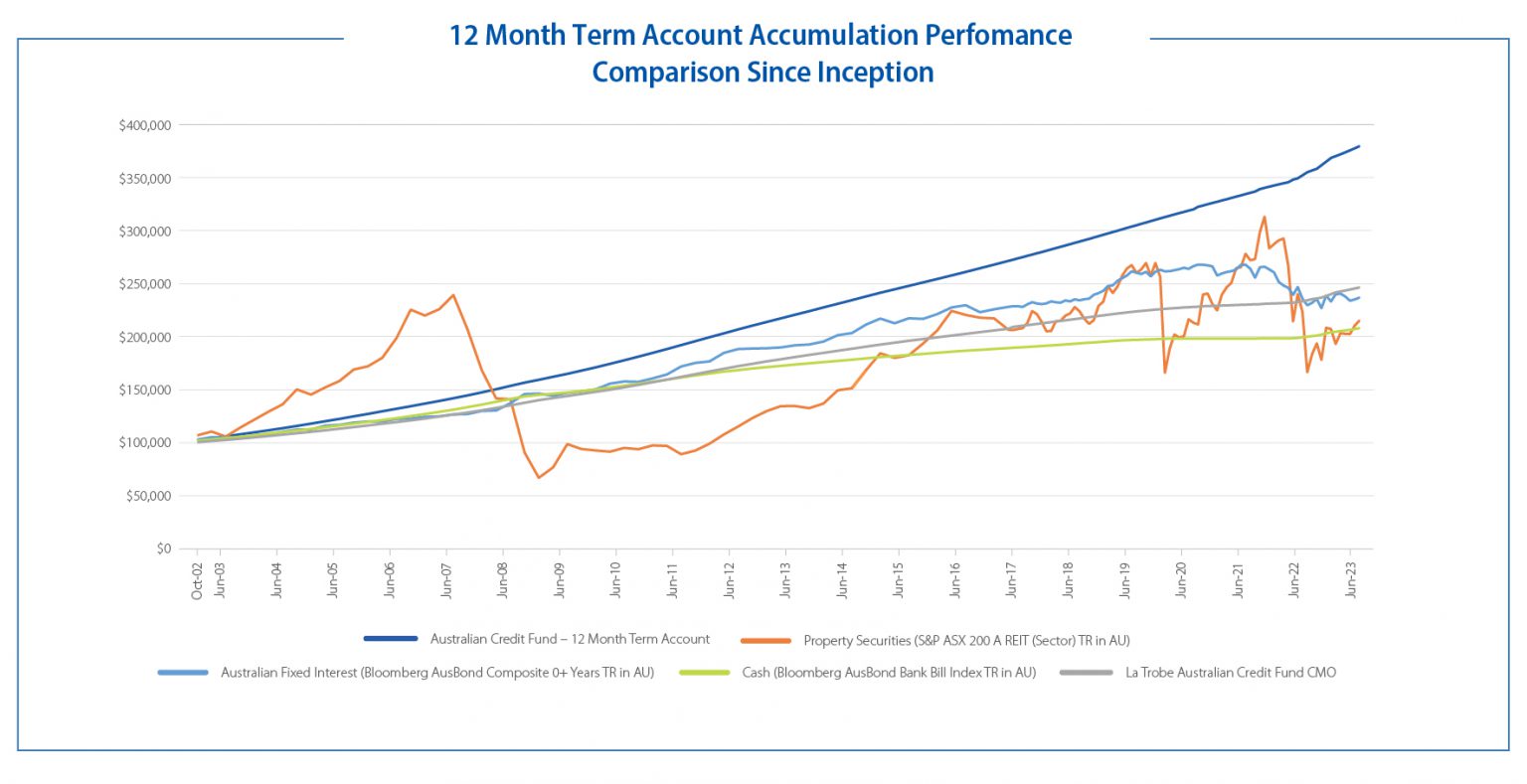

Consider the performance of our flagship 12 Month Term Account over its 21 year history. This is a low volatility outcome with demonstrated performance at all points along the economic cycle:

There’s no room to be complacent, and we know that investors value their La Trobe Financial investments as a form of protection against volatility. However, through no mistake of their own, even the best borrowers can run into difficulty.

This is where borrower quality comes to the fore. Two years into an environment of elevated inflation, and 18 months into a rate hiking cycle, our borrower performance is still within our historical arrears band of 2.5% – 4%pa. The Credit Fund concluded September 2023 with arrears decreasing marginally lower, at 3.6%.

These kinds of statistics aren’t a secret at La Trobe Financial. Any investor, or indeed any interested member of the public can freely locate our Fund Investment Snapshot and Metrics document. This document is uploaded to our website monthly and provides over a thousand individual data points covering portfolio allocations, diversification and performance. And we’re happy to talk to you about them and any particular point that you’re interested in.

This commitment to transparency really sets us apart. Well over a year into an aggressive rate hiking cycle, our portfolios remain in excellent health. They remain well diversified with granular exposures, controlled arrears, and enjoy the benefits of Investor Reserve mechanisms to provision against any potential volatility. Our commitment to remaining sound stewards of your capital is as strong as ever, and we thank each of our 93,000 investors^ for their continued support.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

Past Performance is not a reliable indicator of future performance.

^Total investors is calculated by adding all individual & joint investors (which includes some investors with a current zero balance in their account) to reasonable estimates of investors investing via platform, trusts or SMSFs.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.