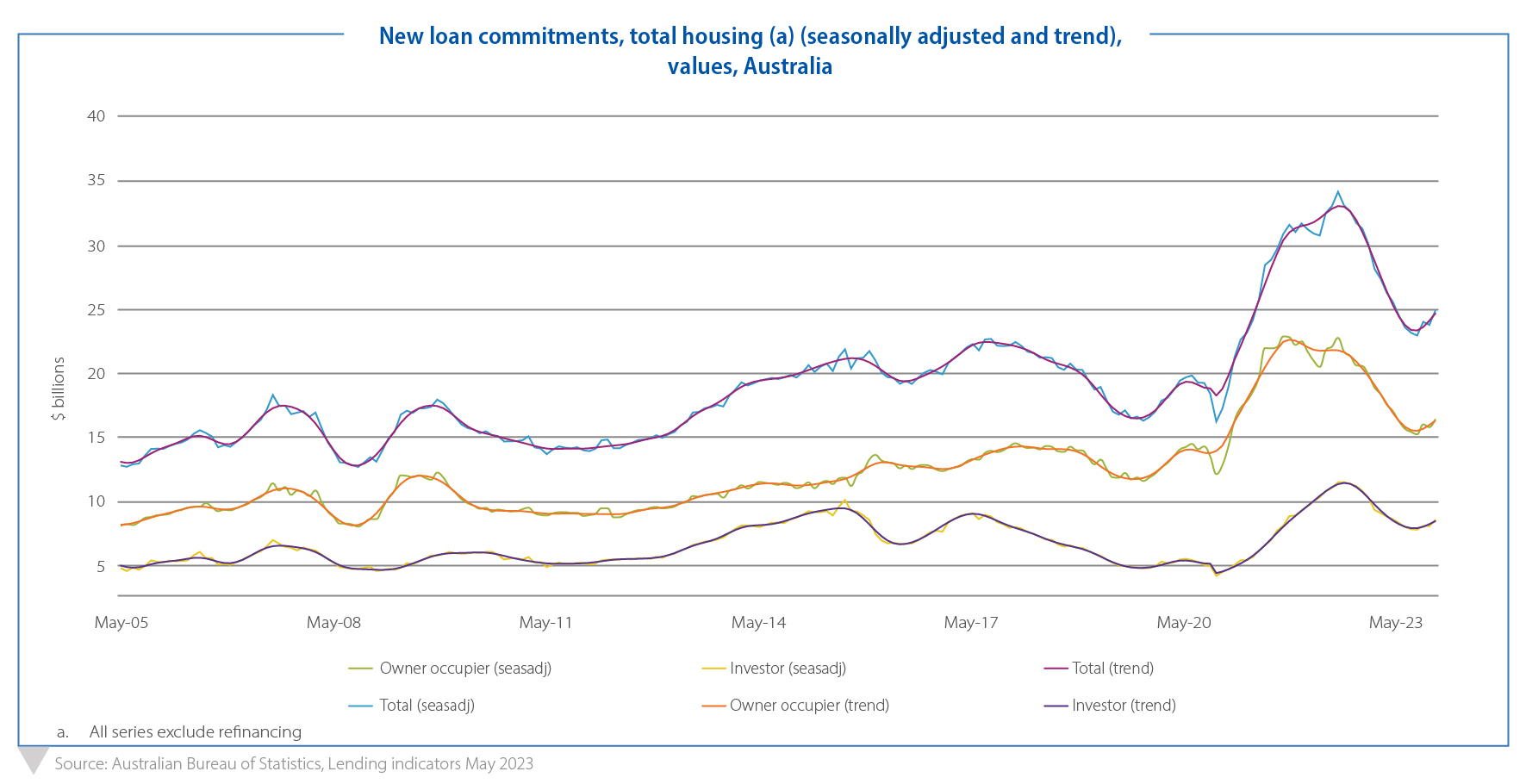

With 12 interest rates hikes under the RBA’s belt over the past 15 months, the froth has certainly come off lending volumes in Australia. In tandem with Australian property prices, the volume of new credit being written in the market reverted to normal levels from their COVID-19 pandemic induced highs. But like property prices, recent data shows that we might be reaching a turning point. Just as property prices have risen nationally across the last quarter, so has the volume of new credit being written.

In the face of increasing interest rates and cost of living pressures, borrowers and potential borrowers have sat on the sidelines. But eventually, the show must go on. A fully employed population, which is growing in number, still has to live somewhere and transact on property – whether as a rental or a property purchase – to secure that place. Driven by owner-occupiers and after thirteen months of consecutive declines, new loan commitments have risen from a low-point in February 2023. Even against the backdrop of ever-increasing interest rates.

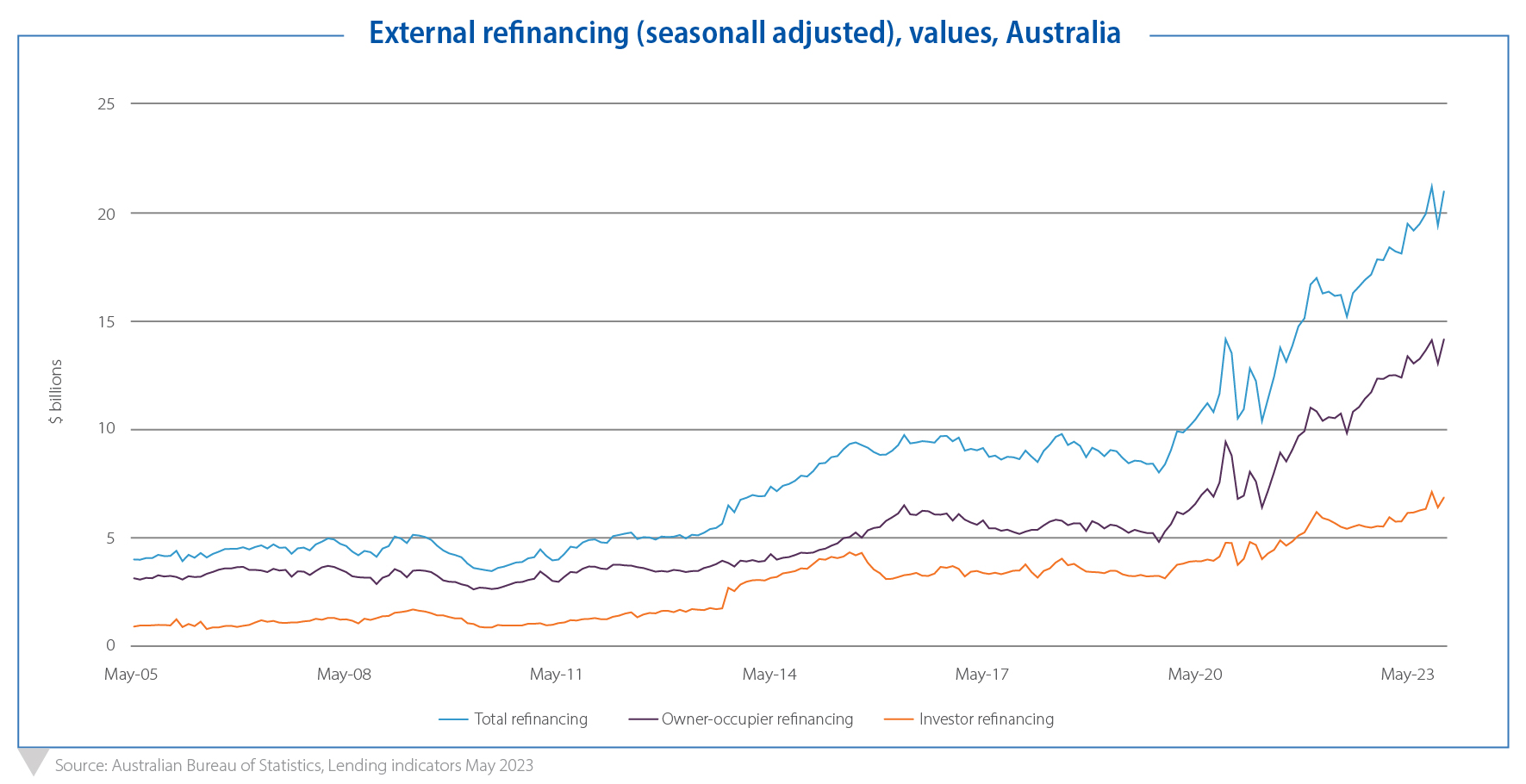

A common worry in the market is that in an environment of increased rates, borrowers become ‘trapped’ in their loans and unable to achieve a refinance. While this may be true of some individuals, overall this does not appear to be the case. Data shows that refinancing activity is at or near its highest ever volumes.

Refinance volumes, driven by rising interest rates and cost of living pressures, have overtaken new loan commitments for the first time since 2020. Across New South Wales, Victoria, Queensland and Western Australia, each are currently seeing more refinancing activity than new loans being written.

Within the lending market, competition still remains favourable for the borrower, with attractive rates, incentives, and customised loan products on offer. With recent interest rate increases hindering the ability of some to demonstrate capacity to service, some Australian Banks have pulled another lever to attract borrowers: Westpac, NAB and CBA have all recently announced they will lower their serviceability buffers from 3% to 1% on refinances, making it easier for borrowers with a good repayment history and strong credit score to refinance. Although it is still too early to call peak rates, this move by these big lenders does signal a likely continuation in the uplift of lending volumes.

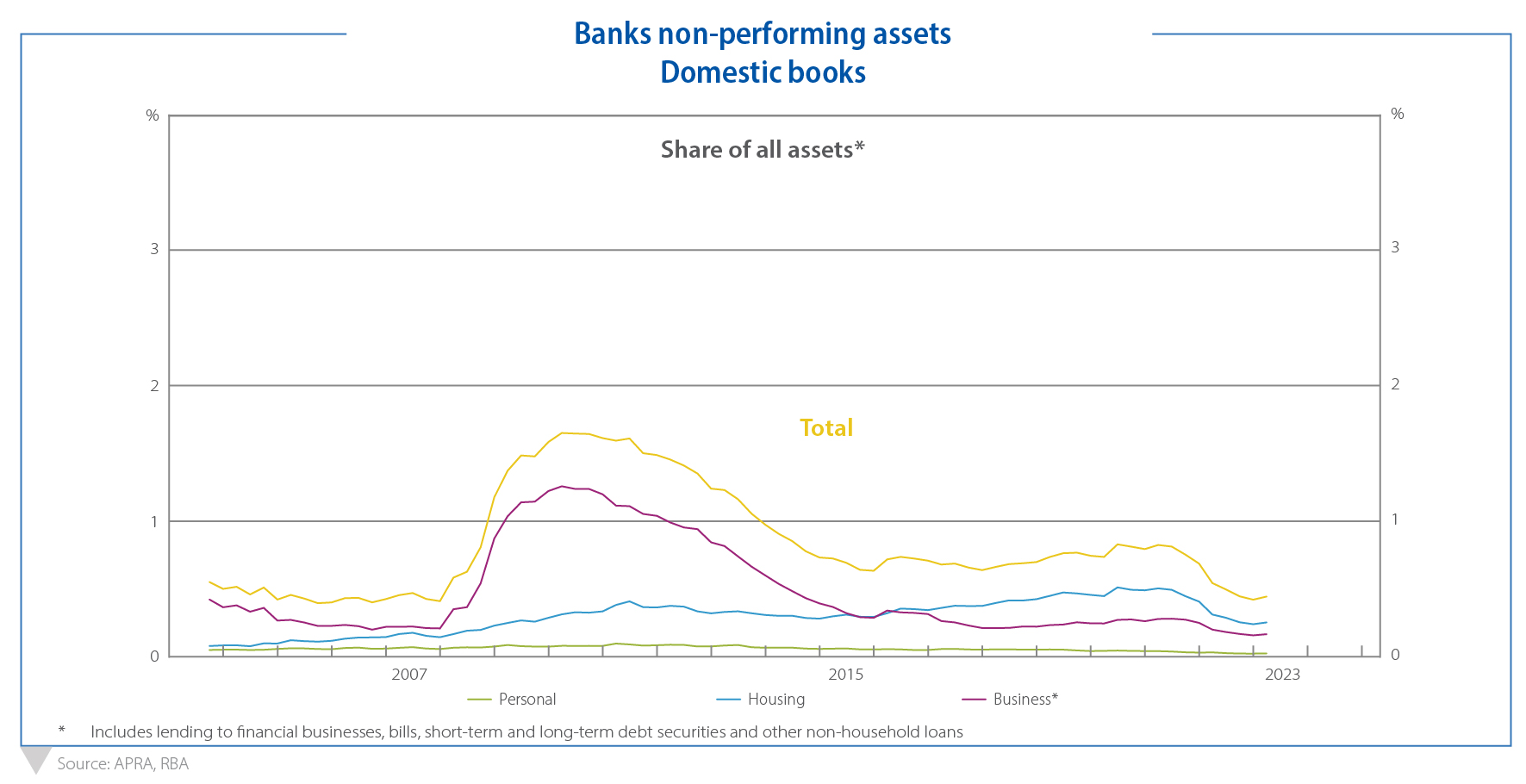

Which brings us back to the theme of Australian Exceptionalism. It would be entirely reasonable to expect that after an extended period of cost-of-living pressures and interest rates hikes that we would see a jump in non-performing loan balances. However, the RBA’s release from June 2023 shows that while arrears are increasing, they remain very low and still below any observation dating back 15 years.

Australia’s unquestionably strong banking sector and well-regulated financial institutions play a crucial role in delivering borrower resilience. This is evidenced by the delivery of loans with demonstrated capacity to sustain repayments even against the backdrop of an aggressive interest rate hiking cycle.

This exceptionalism provides investors with opportunities across incredibly broad and deep pools of high-quality assets, and rewards those investment managers – like La Trobe Financial – who have remained committed to their investment fundamentals and disciplined approach to portfolio construction and management. In a moment where resilience of an investment product is so important, investors considering an allocation within property credit can locate products offering low volatility, inflation-responsive income.

*The rates of return on your investment are current at 1 July 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.