Property Credit – growth slowing but still ahead of long-term averages

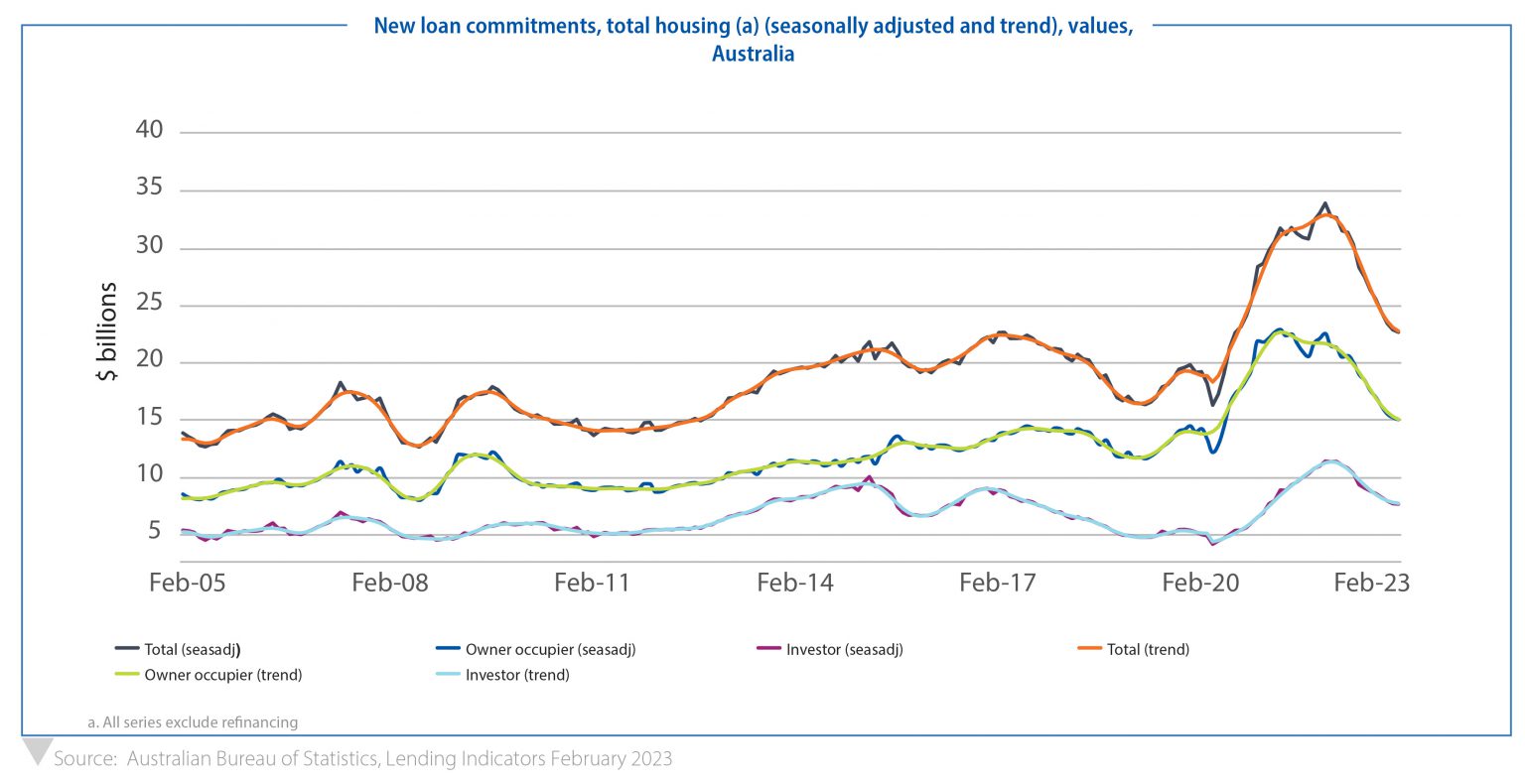

As would be expected post the pandemic, the volumes of credit being written jumped sharply alongside a surging property market. And while the property market resets, lending volumes remain elevated against historic levels.

With credit volumes having peaked in January 2022, the credit sector is now trending towards ‘trough’. Data released earlier this week shows that the rate of decline in property credit is softening across both owner-occupied and investment credit. Both numbers are returning toward trend, with volumes beginning to search for the cyclical trough.

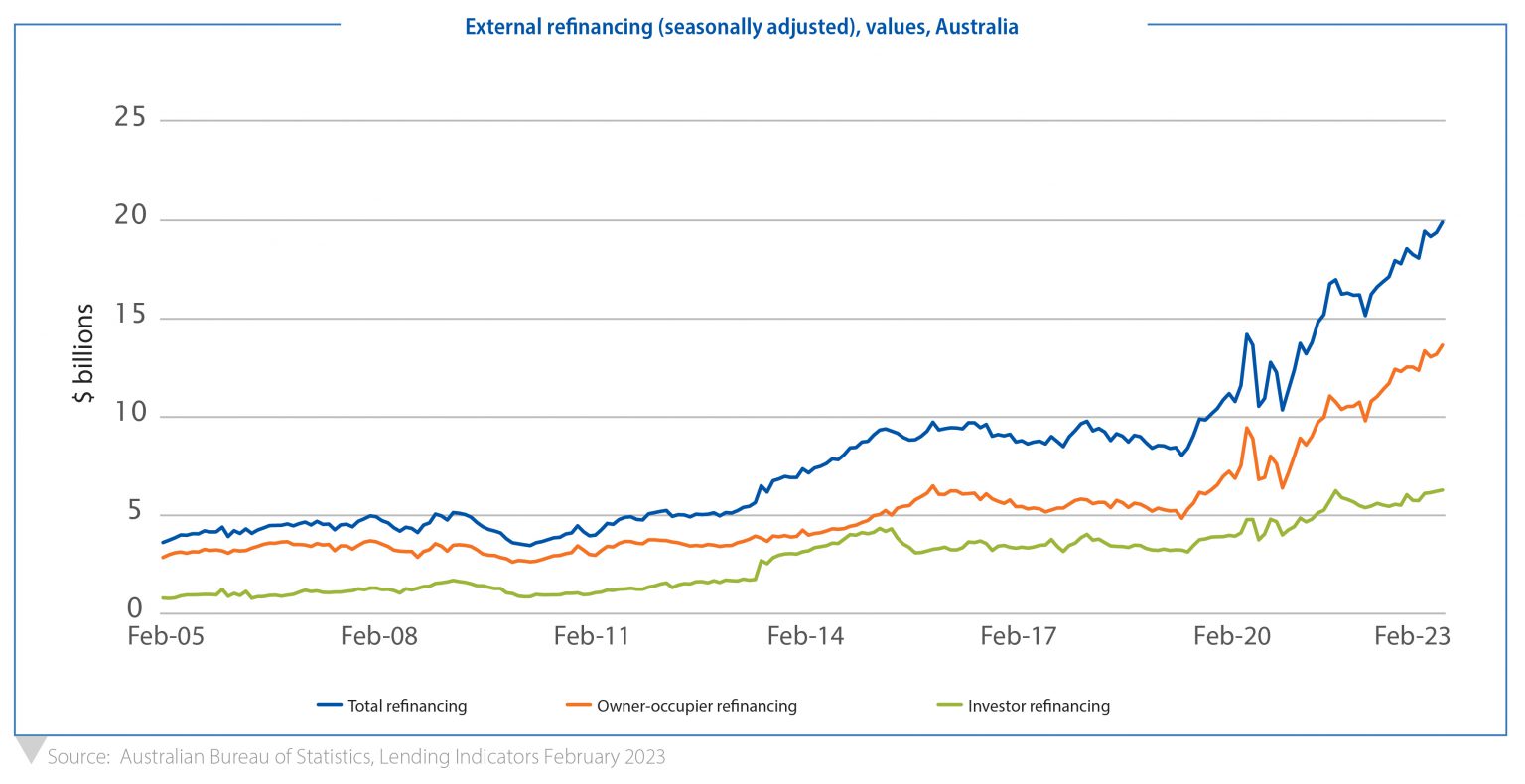

This data excludes refinancing activity, with these statistics telling a very different story. Borrowers know that the ‘best rate’ often lies elsewhere in an increasing interest rate environment and, accordingly, the value of refinanced home loans hit a new record high in February 2023. This is a sure sign that borrowers are very conscious of their increasing monthly outgoings and the impact upon their household balance sheets, and are taking positive action to find a lower rate.

While there has been a moderation in the broader credit market, the same cannot be said for our own lending volumes at La Trobe Financial – our loan approval and settlement numbers for March 2023 represented new peaks as we continue to attract high quality loan applicants. As an asset manager, we remain focused on selecting the highest quality assets available: consider the average credit score of our loan applicants provided by Equifax, a third-party credit ratings agency. As a genuine alternative for high quality borrowers looking to transact, La Trobe Financial’s average borrower credit scores are substantially similar to those of applicants at any of the Big 4 Banks. What’s more, borrower credit quality continues to trend upwards and well above our peers.

The volume and performance of credit are supported by a range of factors. Australia maintains an extremely low unemployment rate, our population is rebounding, and rental yields are increasing – supporting property as an investment proposition.

Borrowers performing well

If a period of strong credit growth fuelled by cheap interest rates were followed by a sharp tightening cycle and cost of living pressures, a reasonable observer would expect to see a material increase in borrower arrears. But to date, this has yet to be the case.

In fact, arrears observations went the other way. Arrears, which did not see a material increase through COVID-19, actually fell industry-wide throughout 2022 to conclude the year at their lowest-ever observations. It would be naïve to suggest any indicator would ever stay near its lowest recorded bound, just as it would be naive to suggest that pockets of individual borrowers are not doing it tough. However, in a macro-sense, Australia’s borrowers are performing incredibly well and are well placed to meet any challenges ahead, particularly given the $280bn in excess household savings accumulated throughout the COVID-19 pandemic which was largely set aside for ‘rainy days’.

For La Trobe Financial, our relentless focus on asset quality puts investors in the best possible position as our portfolios continue to perform across the cycle. Our portfolios couldn’t be in a better place to absorb any mortgage stress within the system, with arrears at the low-end of our usual arrears band, and arrears actually improving in February.

Banks well regulated and well capitalised

Australia is often referred to as ‘the lucky country’, but we have made our luck with banking thanks to a well-regulated sector. The Australian banking regulator, APRA, has taken steps over many years to ensure our banking sector remains ‘unquestionably strong’. Consider the capitalisation of our banks. Not only are they among the best capitalised globally, but capital ratios have also been increasing year on year over recent decades. Accordingly, our banks are in tremendous shape to deal with volatility, as they have shown again and again in recent years.

In today’s busy world, a pause for thought is a rare luxury. While the RBA rate hiking cycle may not be over, this pause allows us to consider Australia’s lending sector, which has taken the challenges of the cycle to date in its stride, and is well placed to meet the challenges ahead.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and Target Market Determinations on our website www.latrobefinancial.com, or ask for a copy by calling us on 1800 818 818.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this email constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© Copyright 2023 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.