Over the past year, the Australian property market has been a topic of great interest and debate, fuelled by media speculation surrounding a potential market crash.

This widespread concern has largely stemmed from the onset of rising interest rates and high inflation, which could ultimately lead to price falls as borrower lending capacity diminishes. Despite the ominous predictions and persistent chatter, the market has yet to experience a large “crash-like” downturn. In fact, property prices might just be turning towards the positive. With the resilience and adaptability of the Australian property market challenging the speculation, we need a more nuanced analysis of the factors driving the current trends.

Combined, the capital cities from the last peak have seen a modest 9.0% fall in property prices. However in March, CoreLogic’s national Home Value Index (HVI) reported a 0.6% month-on-month increase, marking the first rise since April 2022. Dwelling values grew across the four largest capital cities, with Sydney leading the way at 1.4%. This growth can be attributed to low advertised stock levels, tight rental conditions, and increased demand due to overseas migration.

Despite high interest rates and an anticipated economic slowdown, other factors have begun to exert upward pressure on home prices.

Rental Market making property more attractive as an investment

The tight rental market and the moderation in property prices is likely causing some renters to consider purchasing homes instead of renting, although not all will be able to qualify for loans due to high mortgage rates. Additionally, with record high net overseas migration, more permanent or long-term migrants who can afford to buy may skip the rental phase and directly purchase homes because of the undersupply of rental accommodation.

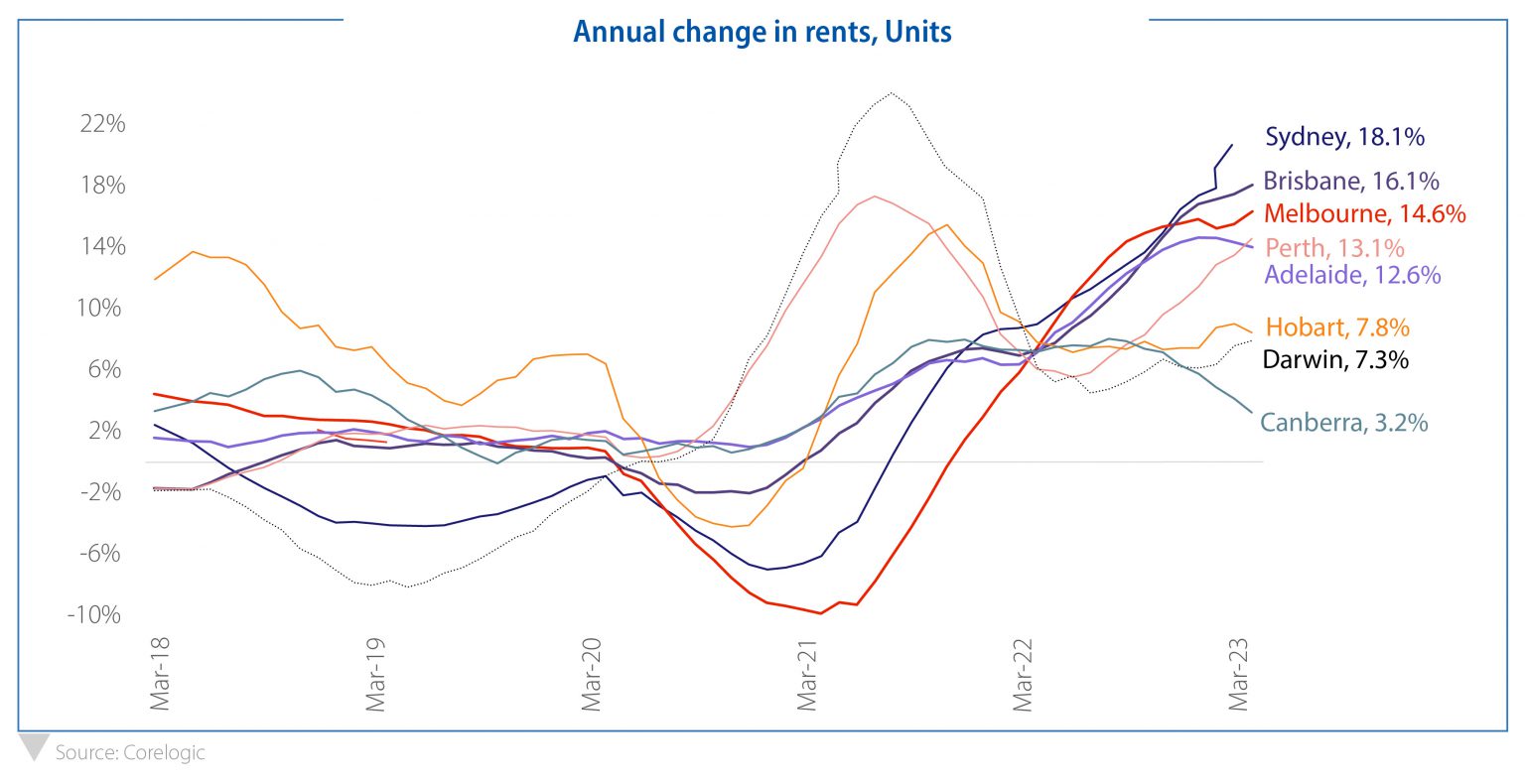

The Q1 2023 CoreLogic Quarterly Rental Review reveals a re-acceleration of rental growth in Australia, driven by demand pressures and a chronic undersupply of rental stock:

- the national rental index rose 2.5%, up from 2.0% in the December quarter;

- annual rental growth remains high at 10.1%, equating to an additional $52 per week or $2,727 a year;

- vacancy rates reached a near-record low of 1.1% in the first three months of 2023, with the total count of national rental listings falling to just under 95,000.

A continually tight rental market, which only serves to make property more attractive as an investment proposition given the lower entry price and greater yields.

Undersupply of Property

Since September 2022, advertised supply has been below average, with capital city listing numbers in March almost 20% below the previous five-year average. Sales activity has also dropped but not by as much as available supply, being roughly 7% below the previous five-year average through the March quarter.

The issue of undersupply is being compounded by the slow-down in construction activity and the unemployment rate.

Since December 2022, the annual total dwelling units commenced is down 21.9%, likely driven by high construction backlogs, higher construction costs, and thinner household balance sheets. With migration at near-record levels, the demand for property will grow but is not being met by a corresponding increase in supply.

And low unemployment is a primary reason for that. With a fully employed population broadly able to maintain their repayments, owners are riding this period out simply by not listing their property for sale. While employment is cooling somewhat, the unemployment rate remains entrenched at near 50-year lows at 3.5% (March 2023), so don’t expect a wave of new supply coming onto the market anytime soon.

Downward Curve is Turning

Although recent housing market trends seem to be improving, one month doesn’t reflect a trend and it’s therefore too early to call the bottom of the cycle. The housing sector, and households for that matter, will continue to face challenges over the next few months:

- there is a delay between cash rate movements by the RBA and their impact on existing borrowers;

- a substantial number of borrowers on a fixed interest rate are maturing into a much higher variable rate environment across the course of this year;

- consumer sentiment remains entrenched in the negative, which might sandbag housing market activity; and

- given high migration, a softening of labour markets is likely which could dampen wage growth, making serviceability for prospective borrowers more challenging

The Australian property market has demonstrated remarkable resilience in the face of rising interest rates and ongoing economic challenges. While market crashes have been widely speculated, recent trends suggest a more nuanced and complex scenario unfolding. As the market continues to evolve, a comprehensive and balanced analysis of the various factors driving trends will be crucial to understanding and navigating the Australian property landscape.

For La Trobe Financial and our credit fund, we will continue to build highly resilient portfolios delivering low-volatility income for investors.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and Target Market Determinations on our website www.latrobefinancial.com.au, or ask for a copy by calling us on 1800 818 818.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

When considering whether to acquire or to continue to hold an interest in the Fund, you should remember that (1) an investment in the Fund is not a bank deposit or a term deposit, and is not covered by the Australian Government’s deposit guarantee scheme. Investing in the Fund has a higher level of risk compared to investing in a term deposit issued by a bank and (2) there are other risks associated with an investment in the Fund. The key risks of investing in the Fund are explained in section 9 of the PDS.

© Copyright 2023 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.