Throughout the past two years, central bankers and politicians the world over have been reaching deep into their kit-bags to produce metaphors which describe their hopes for their respective economies. Talks of ‘soft landings’, ‘narrow paths’ and ‘even keels’ have all entered the accepted lexicon of our economic discussion.

As managers of our investors’ hard earned wealth, it is our job to exercise caution. And while the last couple of years has been punctuated by elevated volatility, there has never been a time in our history completely free of economic, political or some other risk. Indeed, as we begin the last quarter of 2023, there is cause for measured optimism with a resilient local economy holding firm. In short, this is not time to be a Chicken Little.

Let’s start with economic growth.

As inflation around the world soared, central banks countered this with aggressive interest rate hiking cycles. The desired outcome of this is to temper demand, slow consumption, and therefore slow economic growth.

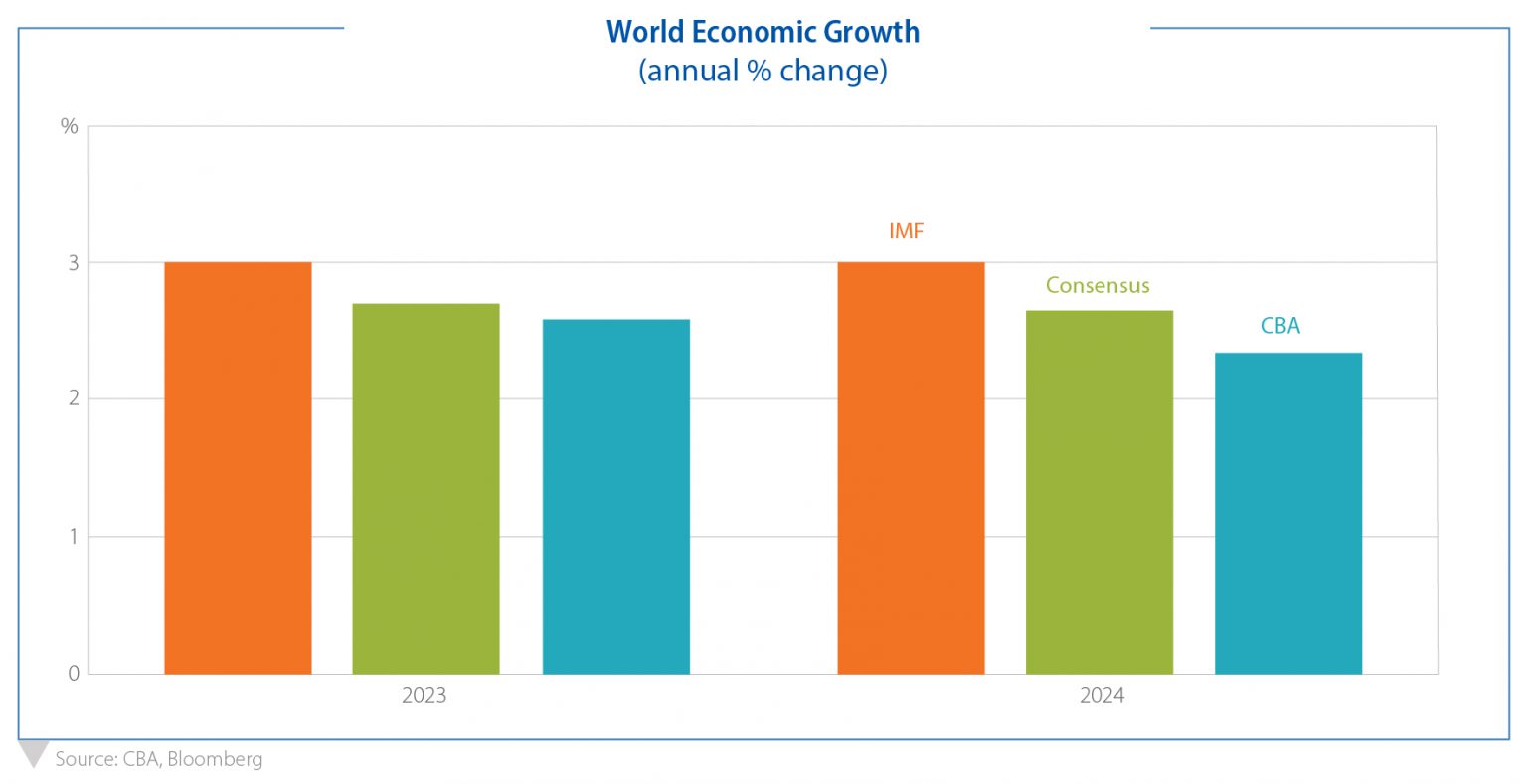

And it has worked. Global growth is predicted to slow to 2.6% in 2023 with CBA predicting a further slowdown to 2.2% for 2024 as the impact from higher interest rates continues to flow through. However, as we have been reiterating throughout, low growth is better than no or negative growth.

Domestically, economic growth numbers are subdued, particularly on a per-capita basis (which is now technically recessionary), but they are positive, and forecast to stay positive this year and next. A story of positive growth will mean we will avoid a recession in Australia, potentially achieving the Reserve Bank’s long-coveted ‘soft-landing’. Great news for our economy and our standing internationally.

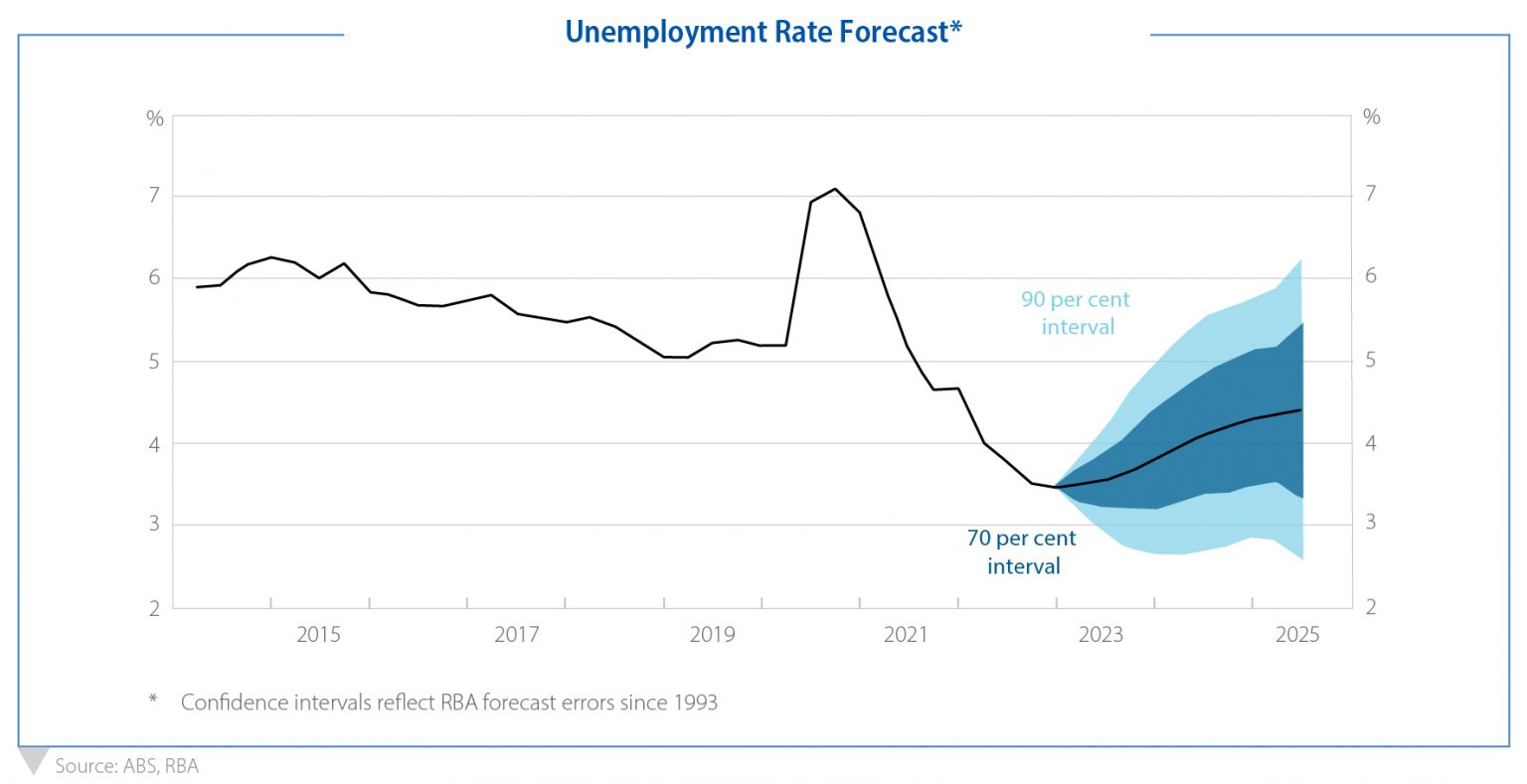

Unemployment has been the good-news story in Australia across these last two years. With borders closed and a rebounding economy, we reached an unemployment number of 3.40% in October 2022, the lowest rate of unemployment in almost 50 years.

Now at 3.70% in August 2023, we are starting to see signs of the employment market loosening. Add to that the surge in net migration and it is likely that the unemployment figure will increase further from here. The Reserve Bank forecasts that the unemployment rate will be 4.50% in 2025 with a range on either side. But this is still a historically low figure. Even the worst of the forecast outcomes would still be close to the definition of ‘full employment’ and well inside the unemployment print we entered the pandemic with.

This is a workforce in really good shape. Long-term unemployment is low. Youth unemployment is low. Unemployment across all of the states is universally low. Meaning households have been as best placed as they possibly could to meet the challenges of high inflation and rising interest rates.

Speaking of rising interest rates, the pace of increase across the last 18 months raises some obvious questions: specifically, the strength of household balance sheets and the performance of mortgage holders.

As a starting point, consider that interest rate rises are designed to slow economies and cool inflation. A tool used to ultimately inflict enough ‘pain’ on households so that, particularly for this cycle, their spending habits will change. As a consequence, unemployment will usually increase, as will borrower arrears with mortgagors asked to pay more per month following each increase to the central bank rate. This is unavoidable.

The soft landings our regulators and governments have been trying to orchestrate is one where these negative outcomes are muted to the extent possible.

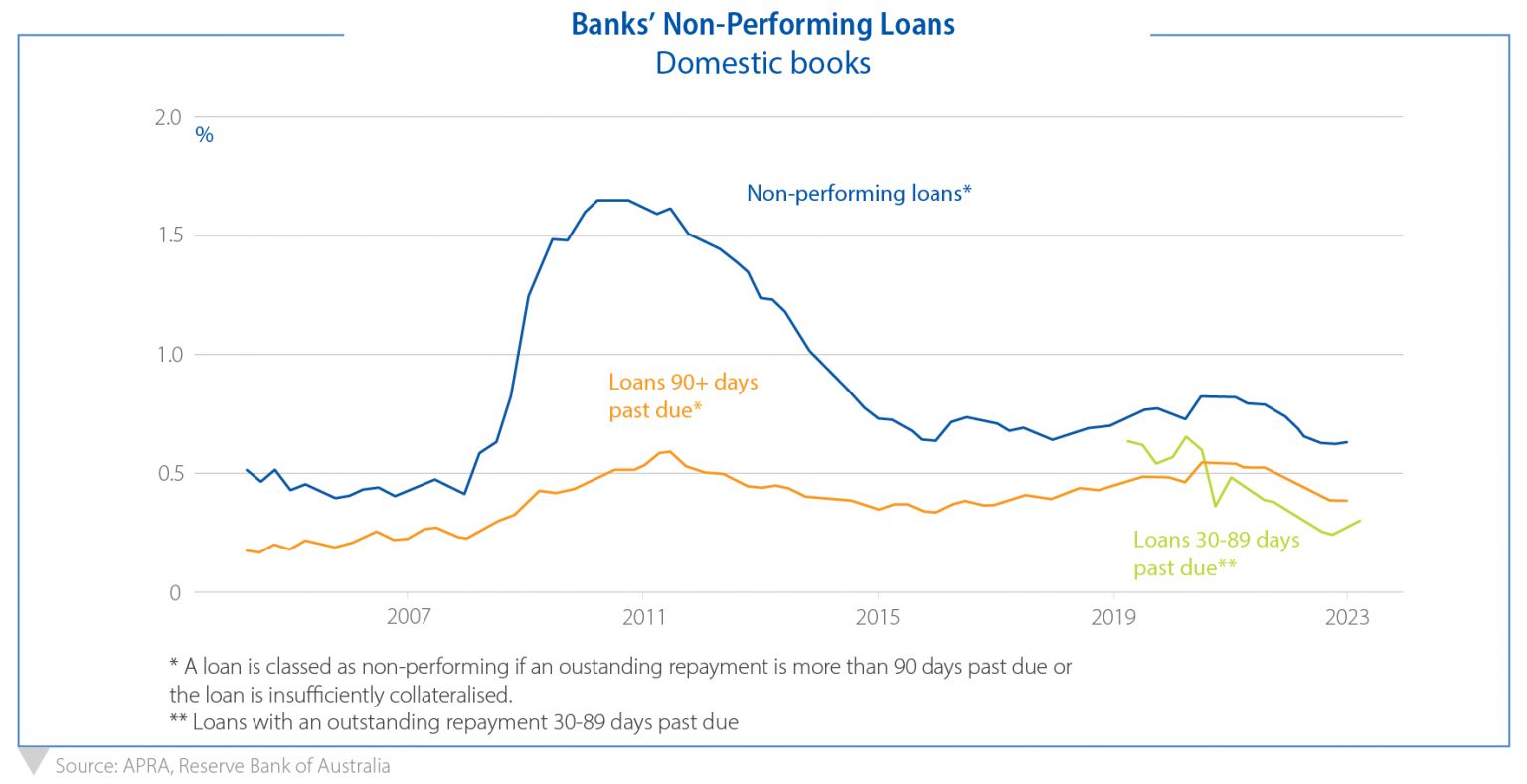

Which leads us to the current mortgage arrears outlook. What we are seeing is that, notwithstanding the 400bps of interest rate rises since May 2022, Australian borrowers are demonstrating their resilience and meeting their increased mortgage repayments. Of course, there are and will be pockets of softness and some households will struggle under the impost of higher mortgage repayments. But, to date, this acorn is not indicative of a wider issue: arrears remain low and controlled with borrower resilience fuelled by strong repayment buffers, low unemployment and $280bn in excess savings accumulated throughout the pandemic period.

It is in the DNA of La Trobe Financial to take a cautious approach to markets and the economy. A view of measured optimism is not to be mistaken for naivety. Decades of experience demonstrates that low-volatility investment outcomes are achieved by looking beyond the horizon, while avoiding getting caught up in undue market hype. We carefully construct portfolios to perform across the market and economic cycle, with our history covering the 34 years of our Asset Management business.

Avoiding undue hype also works the other way, by not reacting to overstated panic. With three consecutive pauses by the RBA, the Official Cash Rate seems at its cyclical peak and there remain plenty of cases for some measured optimism into the years ahead.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.